Evotec SE (EVT) – Corrective Zigzag Targets 7.80 EUR

📅 Timeframe

1-Hour

📉 Asset

Evotec SE (GETTEX: EVT)

🎯 Direction

Corrective rally within a broader decline

✅ Target Zone

7.70 – 7.80 EUR (extension to 11.00 EUR only if broken)

📍 Current Status

Wave C advancing toward supply

🔎 Chart & Replay

Click to open live replay on TradingView.

🧠 Short Analysis Summary

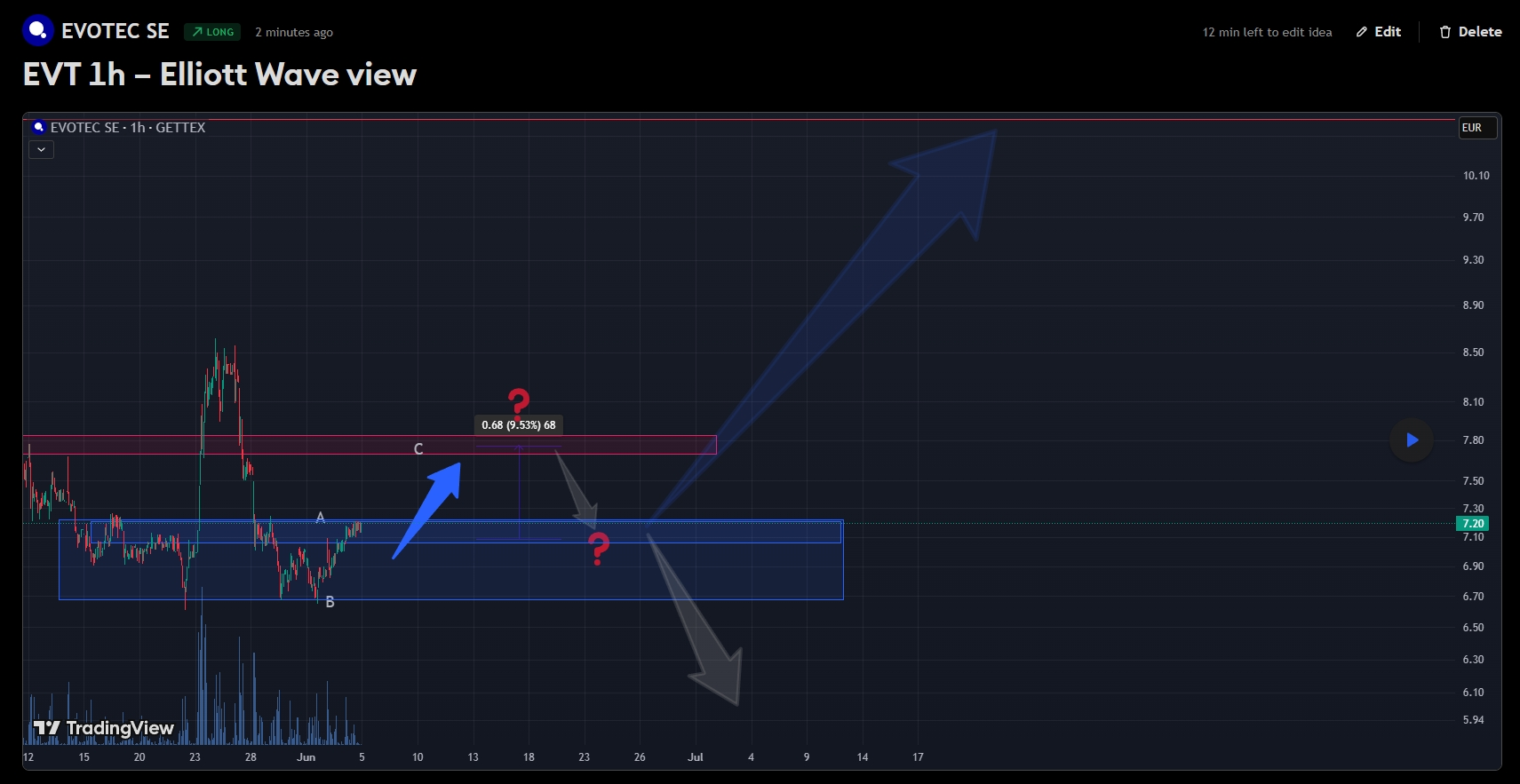

The plunge from 8.50 EUR carved a textbook five-wave impulse that bottomed at 6.50 EUR. Price action since then is unfolding as an A-B-C zigzag:

- Wave A – swift thrust from 6.70 EUR to 7.20 EUR.

- Wave B – deep, time-consuming pull-back to 6.90 EUR.

- Wave C – now lifting price toward 7.70 – 7.80 EUR.

Volume and momentum lag the rally, supporting the corrective reading. Until 7.80 EUR is conquered decisively, the move is viewed as a counter-trend bounce.

Detailed Breakdown

1. Demand – the Blue Box (7.05 – 7.25 EUR)

This pocket coincides with the lower edge of a prior range, a high-volume node, and the 38 % retrace of Wave A. Each visit has produced spring-type candles, confirming active bids. Long setups favor entries here with stops below 6.90 EUR.

2. Supply – the Red Box (7.70 – 7.80 EUR)

Here lie three overlapping barriers:

- underside of a broken consolidation base,

- 61.8 % Fibonacci retrace of the 8.50 → 6.50 EUR sell-off,

- upper rail of a corrective channel.

Wave C statistically ends near this Fib cluster, making the zone ideal for profit-taking or fresh shorts.

3. Two Likely Paths

Fast Resolution – Price punches straight into 7.80 EUR, prints exhaustion candles, then rolls back to 7.20 / 6.90 EUR as a larger decline resumes.

Time Burn – Price first drifts sideways inside the blue range, builds an expanded flat, then makes one final spike into supply before reversing. Same destination, slower clock.

4. Invalidation & Alternate Scenario

The corrective thesis fails only if price rallies through 7.80 EUR in a clear five-wave sequence and retests the area as support. Such strength would open a path toward the origin of the sell-off near 11.00 EUR and challenge the falling trend line that has capped rallies for months.

📈 Result Summary

Bulls have the micro-trend while 7.05 EUR holds, but the rally’s corrective signature warns of limited lifespan. A stall inside 7.70 – 7.80 EUR should usher in a return to the blue demand band. Aggressive longs trail stops under 7.05 EUR; counter-trend traders watch supply for bearish reversal triggers with risk capped above 7.95 EUR.

Closing: cakirinsights.com